Although the Old Parish Registers of Births and Baptisms for the parish of Luss only begin in 1698, we can go back a further seven years thanks to the Hearth Tax Rolls where a number of McAuslands were assessed for tax, including Alexander McAusland, the last Baron of Caldenah and our possible great (x7) grandfather Humphrey McAusland in Inverlaran.

The Hearth Tax Rolls

ScotlandsPlaces has digitised and transcribed some very useful records, the Hearth Tax Rolls. They explain:

Hearth tax rolls list the people who were liable for tax on hearths (including kilns) in Scotland in the 1690s. They provide clues about the size of each building, place, estate or parish in the late 17th century. Heads of households of each building were liable for a tax of 14 shillings, payable at Candlemas 1691, and only hospitals and the poor were exempt. There were huge difficulties in collecting the tax, particularly in the Highlands, and attempts to collect the tax in some parts of Scotland went on until 1695.

The surviving hearth tax rolls (National Records of Scotland reference E69) are generally arranged by county and then parish or by landed estate. The rolls for the following counties contain lists of householders (some arranged by estate or place): Angus, Ayr, Argyll (but with some areas missing), Bute, Berwick, Clackmannan, Dumbarton, East Lothian, Fife, Kincardine, Lanark, Midlothian, Perth, Renfrew, Roxburgh, Stirling, Sutherland, West Lothian and Wigtown.

The rolls for the counties of Aberdeen, Banff, Dumfries, Kirkcudbright, Moray, Nairn, Peebles and Selkirk give only the total number of hearths surveyed and money collected in each parish or estate. The roll for Inverness-shire consists mainly of a summary of a small number of parishes without listing inhabitants but includes a list of burgesses or inhabitants of the town of Inverness and a list of poor in the parishes surveyed.

In this series of hearth tax rolls there are none for Orkney, Shetland, Caithness, Ross and Cromarty. For information on hearth tax rolls for Dumfriesshire, Fife, Edinburgh, Shetland and Ross-shire in private records in the NRS see the guide on tax records at www.nas.gov.uk/guides/taxation.asp.

Please note that hearth tax records are difficult to read, if you are not familiar with 17th century handwriting. For guidance on 17th century handwriting visit www.scottishhandwriting.com.

Luss parish Hearth tax records for 1691-1695

Ane list of the herors [heritors] Lifrentirs & vthrs [others] within the paroch of luss

there hearths & quantitie therof as Follows:

At the top of the page is listed the local Laird with his 22 hearths and then his gardener.

Imp [Imprimis] The Laird Luss in his own house and office houss [houses] — 22 hearths

John Crawfurd gardiner — 1

Humphra McCauslune in Innerlarran and John Glen there

Next on the list we find (see image above):

Humphra mccauslune & John mckinlay in Innerlarran — 2

Also at Innerlarran were (not shown above):

John mcwilliam and [–] widow thr [there] — 2

John and John Glens houses & a kill there — 3

Donald mcneill cottar thr [there] — 1

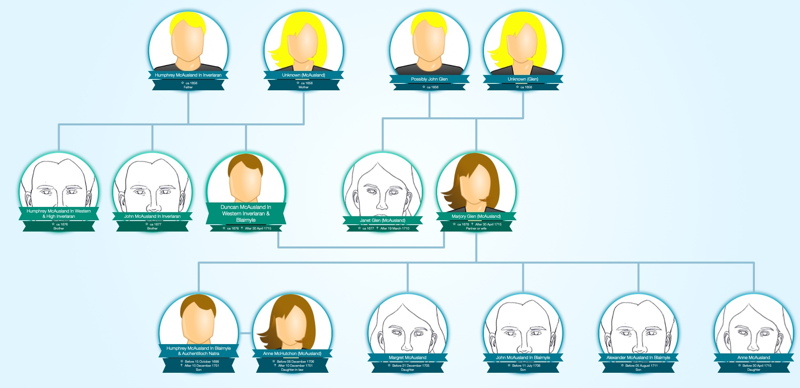

It is believed that the Humphra McCauslune in Innerlarran who was assessed for hearth tax in 1691 may be our great (x7) grandfather. He is believed to be the father of Humphrey McAusland in Western & High Inverlaran, John McAusland in Inverlaran, and our great (x6) grandfather, Duncan McAusland in Western Inverlaran & Blairnyle.

John Glen who also has a house there may also be our great (x7) grandfather. He is believed to be the father of Janet Glen who married John McAusland and also of our great (x6) grandmother, Marjory Glen, who married Duncan McAusland in Western Inverlaran & Blairnyle.

Allexander McCauslane of Caldenah & John McCausland in Prestilach

Towards the bottom of the second page we find:

Allexander mccauslane of Caldenah — 1

John mccauslan in prestilach & his son –2

[–] in Caldenah — 2

Note that there is a crucial difference between being described as “of” a place and being merely referred to as “in” a place, in the parlance of land records. Someone who is “of” a property implies having a charter to the place in question, as opposed to being merely a tenant, or occupier.

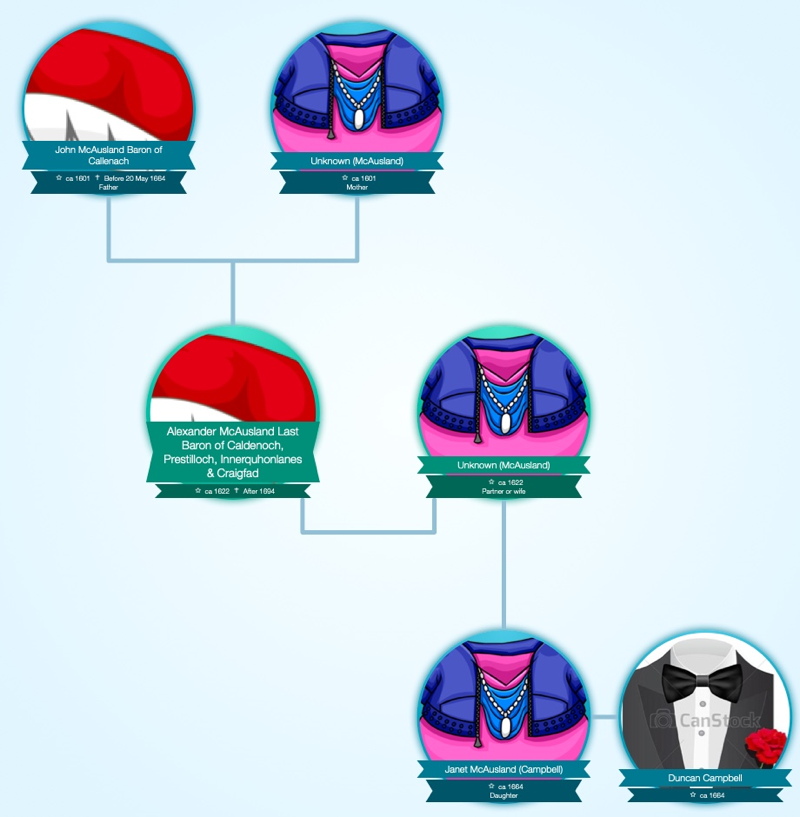

The Allexander McCauslane of Caldenah mentioned in the Hearth Tax Rolls would presumably be the last Baron of Caldenoch, Prestilloch, Innerquhonlanes & Craigfad, whose daughter, Janet sold the McAusland lands to Sir Humphrey Colquhoun (Laird of Luss 1688-1718) some time between 1694 and 1718.

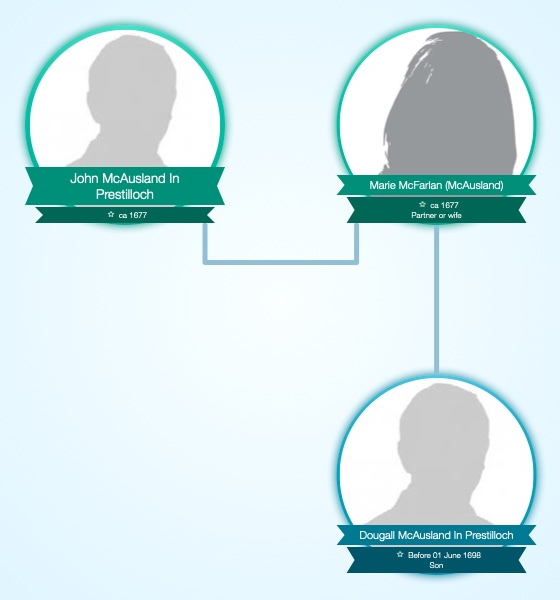

A Dougal McAusland was born in Prestilloch and baptised on 1st June 1698 to John McAusland and his wife Marie McFarlane. He is assumed to be either the John McCaslan in Prestilach named in the Hearth Tax Roll, or his unnamed son.

Heritors

A heritor was a privileged person in a parish in Scots law. In its original acceptation, it signified the proprietor of a heritable subject, but, in the law relating to parish government, the term was confined to such proprietors of lands or houses as were liable, as written in their title deeds, for the payment of public burdens, such as the minister‘s stipend, manse and glebe assessments, schoolmaster’s salary, poor rates, rogue-money (for preventing crime) as well as road and bridge assessments, and others like public and county burdens or, more generally, cess, a land tax. A liferenter might be liable to cess and so be entitled to vote as an heritor in the appointment of the minister, schoolmaster, etc. The occasional female landholder so liable was known as a heritrix.

In Scotland the term heritor was used to denote the feudal landholders of a parish until the early 20th century. For example, in the early 20th century the heritors of the Highland Parish of Crathie and Braemar were the estates of Mar Lodge, Invercauld, Balmoral, and Abergeldie.

Historically, land-holding in Scotland is feudal in nature, meaning that all land is technically “owned” by the Crown, which, centuries ago, gave it out – feued it – to various tenants-in-chief in return for specified services or obligations. These obligations became largely financial in time, or ceremonial or at least notional. Similarly, these tenants-in-chief gave parcels of land out to lesser “owners”, and the resulting reciprocal obligations too became financial – feudal dues – or notional. Often, though, conditions were imposed by the feudal superior at the time of the transaction – used in the 19th century as a form of planning control.

The result was that “landowners” had differing rights to the land they “owned”. However, those who held their land without limit of time – that is, only had a ceremonial or ancient financial obligation towards their notional “superiors” – were distinguished from others and were called heritors. In effect, they were the gentry of the Scots countryside, with legal privileges and obligations. Most ordinary farmers rented their land for a specific period of time from the heritors.

Like the gentry in other countries, the heritors ruled the countryside. They were responsible for justice, law and order in their district and for keeping the roads in good repair. They were responsible for appointing – and paying – the minister and the schoolmaster, and for maintaining the church, manse and schoolhouse. They had also to provide for the poor of their parish. For all this they levied a rate on all the heritors in the parish – and often included non-heritor tenant farmers in the rate.